Exemplary Info About How To Avoid Irs Audit

While no one can guarantee they won’t be audited by the irs, it’s a valid concern as tax audits can be quite stressful.

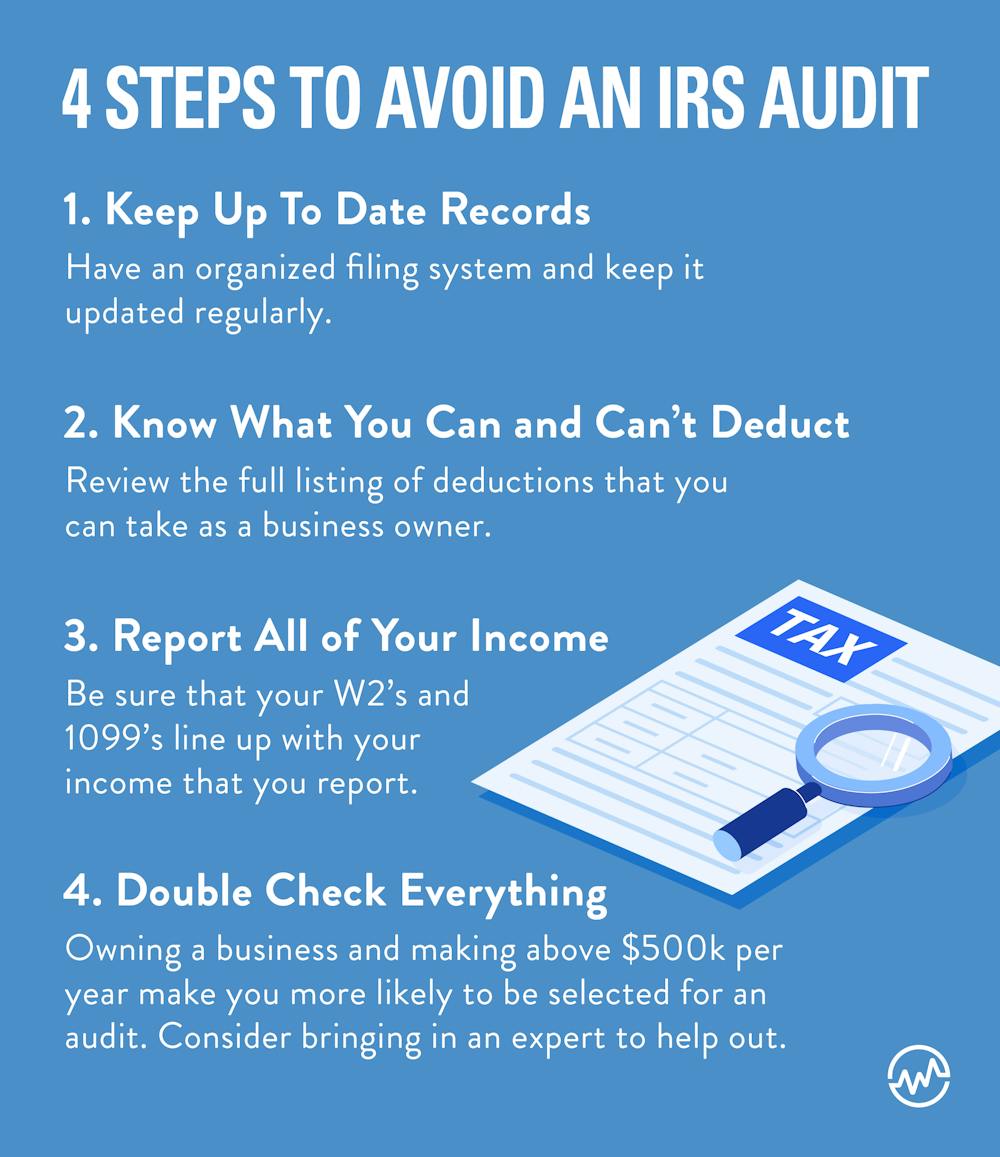

How to avoid irs audit. Are you an irs tax audit risk because of how you file your taxes? Keep detailed records of your expenses, income, receipts, and invoices. However, a representative must have written authorization to act for you.

There are certain irs audit red flags that increase your odds dramatically and the irs loves catching. Millions of dollars of tax deductions are at stake. Sometimes, a few adjustments are all you need to avoid being in the audit pile.

Experts say there are a number of things people can do to lower the chance of getting audited by the irs. How to (try to) avoid a tax audit. According to the irs, the typical taxpayer reports an income of less than $200,000.

The odds are low that you'll be audited: Keep the irs out of your business: In this post, we’ll review the types of irs.

6 common tax mistakes could trigger an irs audit. Don’t amend your return, unless you have to amended returns are usually. Jill shah | apr 14, 2022.

So here are tips from leading financial advisors about how to do just that. Who gets audited the most? Here are a few ways to lower the odds of getting audited this tax season:

Taxpayers earning more than $1,000,000 each year have greater odds of an irs audit. Understanding the audit process and adhering to irs guidelines are critical in minimizing audit risk. The interview may be at an irs office (office audit) or at the.

In 2022, 23 of 1000 returns, or 2.3%, were audited at this income level. Ensuring accuracy in your tax returns is one of the foremost. There is no guaranteed way to avoid an irs audit but there are things you can do to lower your probability of being audited.

Taking a bit of extra time while filling out your 2024 return can help stave off any. Save yourself the headache because whether you’re right or wrong, it’s still a headache when you have.

Check out these tips to reduce your likelihood of being. A tax audit can be painful, scary and costly. Avoid cash transactions for your business if at all possible.

![How To Prepare For An IRS Audit [INFOGRAPHIC] Tax Relief Center](https://help.taxreliefcenter.org/wp-content/uploads/2019/04/TRC-PIN-How-To-Prepare-For-An-IRS-Audit.png)

.png?1678143900)